Written by Albert Ottoni

I am often dumbfounded that so-called astute economists and business media reporters still drink the U.S. Fed “guidance” cool-aid about what is still driving monetary policy decisions post crisis, as well as the jawboning ways that they in the FOMC manipulate policy perceptions under a guise of “increased transparency.”

As David Stockman recently noted, one of the most deplorable aspects of Greenspan’s and Bernanke’s monetary central planning was the lame proposition that financial bubbles somehow can’t be detected, and that “the job of central banks is to wait until they crash and then flood the market with liquidity to contain the damage.” Turns out, the emperor really has no clothes, and financial bubbles are, in fact, all they know how to create, and keep creating them over and over again.

I love a recent quote from Stockman that, “In fact, after the giant housing bubble crashed and left millions of Main Street victims holding the bag, Greenspan evacuated the Eccles Building, and then spent nearly a whole chapter in his memoirs explaining how this devastation wasn’t his fault.”

As Stockman knows firsthand, Fed officials are data hounds, and absolutely knew with exact precision how housing prices in the US rose for 111 straight months from late 1994 to late 2006, and during that period increased by nearly 200% on average across US neighborhoods.

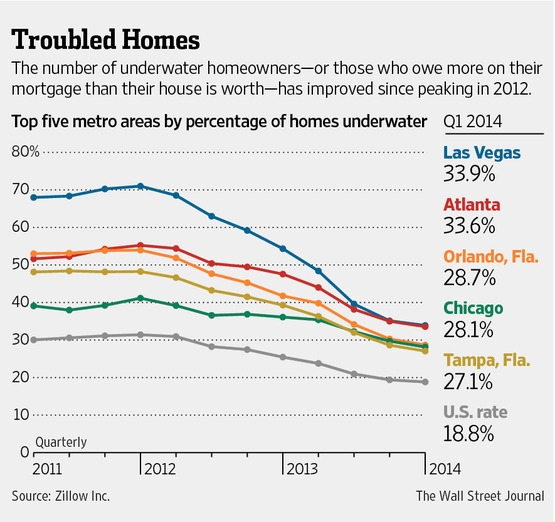

So forgive me for saying Janet Yellen and co, but I have one chart below that perhaps may be the only one I need to track in order to get a sense of how much longer extraordinarily loose monetary policy will be around, as well as ZIRP and negative real interest rate policy (aka, the printing press). The chart below tells me tapering will continue slowly, but you Feds are no where near the end of your “reflation” strategy (aka bubble recreation) in terms of the likely path of short term rates in the next year or two.

For policy makers who only know financial and credit bubbles, they only need to look at the fact that 96 months after the housing peak, there are still 20 million households which are either underwater on their mortgages or do not have enough embedded equity to cover the transaction costs and down payment needed to move.

As David Stockman notes, “It is no great mystery that, historically trade-up borrowers have been the motor force that drove the US housing market. Selling their existing home for a better castle, trade-up buyers vacated the bottom-end of the market so that first time buyers could find a foothold.” Wash, rinse, spin, repeat….

“Now thanks to Washington’s eternal conviction that debt it the magic elixir of economic growth, first time buyers are few and far between because they are buried in student debt—-about $1.1 trillion to be exact. Each graduating class has more students with loans to carry forward, and in higher and more onerous amounts. Fully 70% of the class of 2014 has student loans, and they average of about $30,000 each. Both figures are triple what they were just a decade ago.”

By Conor Dougherty at The Wall Street Journa

From WSJ .”Nearly 10 million U.S. households still remain stuck in homes worth less than their mortgage and a similar number have so little equity they can’t meet the expenses of selling a home, trends that help explain recent sluggishness in the housing recovery.

At the end of the first quarter, some 18.8% of U.S. homeowners with a mortgage—9.7 million households—were “underwater” on their mortgage, according to a report scheduled for release Tuesday by real-estate information site Zillow Inc.

While that is an improvement from 19.4% at the end of last year and a peak of 31.4% 2012, those figures understate the problem.

In addition to the homeowners who are underwater, roughly 10 million households have 20% or less equity in their homes, which makes it difficult for them to sell their homes without dipping into their savings. Most move-up homeowners typically use their home equity to cover broker fees, closing costs and a down payment for their next home. Without those funds, many homeowners can’t sell.

“It’s a sobering appreciation that negative equity is going to be with us for a while to come,” said Stan Humphries, Zillow’s chief economist. “Negative equity is central to understanding a lot of the distortions in the marketplace right now.”

Those distortions include the inventory of homes for sale, which, while rising, is low by historical standards. It also helps explain why first-time home buyers are having such a hard time cracking the market. Real estate is in some ways like a ladder, Mr. Humphries notes, so when underwater homeowners don’t trade up it makes it harder for newcomers to get in.

Chttp://online.wsj.com/news/articles/SB1000142405270230442270457957226175…